The last step of developing a master budget uses the components you have compiled to create a budgeted balance sheet. The budgeted balance sheet predicts the final effect of costs and sales on the company’s balance sheet. AI technology can be used to automate and streamline the budgeting process. For instance, businesses can use AI-powered chatbots to answer budget questions, track expenses, and generate reports. AI can also help businesses identify trends and patterns in financial data, making it easier to create more accurate budgets.

When Should a Business Start Preparing Its Master Budget, and How Often Should It Be Updated?

- In order to handle changes that occur in the future, companies can also use a rolling budget, which is one that is continuously updated.

- Businesses should consider these external factors when preparing their master budget to ensure accuracy and reliability.

- It is common to use several different direct materials to produce a final product in a manufacturing environment.

- Product costs-direct material, direct labor, and manufacturing overhead-are included in the cost of goods sold budget.

- You need the schedule of expected inflows from clients and outflows to suppliers to calculate the net cash position of the firm.

The budgeted balance sheet gives the ending balances of the asset, liability, and equity accounts if budgeting plans hold true during the budgeting time period. A strategic plan usually forms the basis what is a master budget for an organization’s various budgets, which all come together in the master budget. It usually coincides with the fiscal year of the firm and can be broken down into quarters and further into months.

The role of financial budgets

- Notice that as one month rolls off (is completed) another month is added to the budget so that four quarters of a year are always presented.

- When a company undergoes the merger and acquisition process, then the master budget is prepared to see what the company gains from the transaction of acquiring the target company.

- The budget is used to control operations during the time period covered by the budget.

- This budget is prepared under the guidance of the Budget director, which is usually the Controller of the company.

Direct labor is manufacturing labor costs that can be easily and economically traced to the production of the product. Variable costs are the same cost per unit but the total cost depends on the quantity produced, used, or sold. The master budget is exactly as the term describes – the budget that exists above all others. It will contain every source of revenue coming into the business and every cost the business will need to pay for. Budgeting helps plan for those times when cash is in short supply and bills need to be paid. DaQuan can see the months when the cash payments exceed the cash receipts and when the company is in danger of having a cash balance below the minimum requirement of $10,000.

Helps Identify Potential Risks

This means considering the impact of their financial decisions on the environment, society, and the economy. Sustainability ensures that businesses act socially responsibly and contribute to the common good. Businesses should ensure that the budgeting process is fair to all stakeholders. This includes treating employees and suppliers fairly and not exploiting them.

Start with sales

Lord’s firm helps venture-backed startups create financial plans and master budgets. Assume that each unit of Water Wiz requires 0.25 direct labor hours to complete. Zero-based budgeting begins with zero dollars and then adds to the budget only revenues and expenses that can be supported or justified.

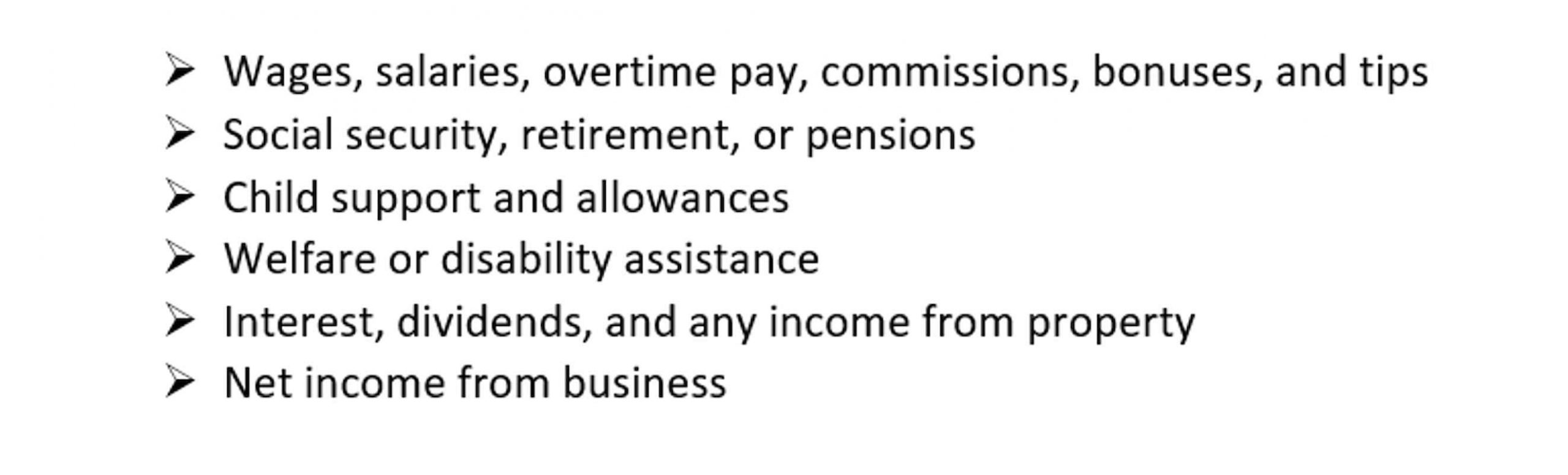

Identifying these risks can help businesses develop contingency plans to mitigate the impact of these events. Master budgeting is a vital process that allows businesses to plan and manage their finances effectively. A master budget is a comprehensive financial plan that outlines a company’s revenue, expenses, and cash flow over a specific period, usually one year. Income-generating activities are listed out in a sales budget, while annual expenses are documented in labor, general administrative, and production budgets. The inputs of all of these budgets are used to compile high-level financial statements that show a company’s total sales, expenses, and profits.

The primary objective of a master budget is to provide a comprehensive financial plan that guides the company’s financial operations throughout the year. The central aspect to remember about this budget is the sum of all the individual budgets made within separate departments, thus providing a vital link between sales, production, and costs. It helps to ensure that all the departments work together to achieve the common objective of the overall business. Master budget accounting becomes a tool for the management to identify its goals well in advance and channel the organization’s resources towards them. It should be noted that the budget should be prepared with the utmost caution as it affects the operational performance of the entire organization.

Video Illustration 6-4: Preparing the direct labor budget

The direct labor costs per unit is calculated at the bottom of the direct labor budget. It is common to use several different direct materials to produce a final product in a manufacturing environment. For example, the production of a student desk may require three direct materials–wood, hardware, and stain. It is also common for the quantity of raw material used to produce one unit of product to be more or less than one unit of the raw material.

Video Illustration 6-2: Preparing the production budget

The overhead budget includes fixed and variable expenses, such as office rent, utilities, and business insurance. It covers indirect expenses that cannot be directly traced to a product or service. The overhead budget is essential for managing indirect expenses, optimizing cost structures, and achieving profit margins. Monthly updates suit businesses with a complex financial planning cycle, such as those with multiple products, services, or revenue streams. Monthly updates allow businesses to track their financial performance in real-time and make informed decisions based on the available data. In addition to the fiscal year, businesses should consider external factors that may impact their financial performance.